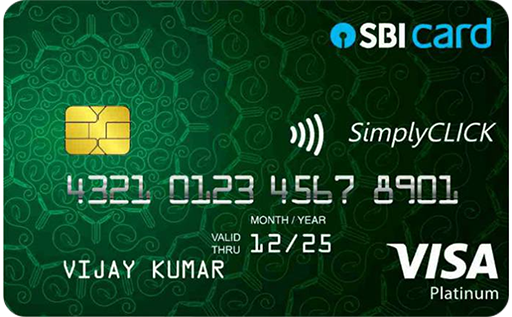

The SBI SimplyCLICK Credit Card is a credit card that is designed for entry-level shopping and is one of the most popular SBI credit cards in the entry-level segment, particularly with new cardholders. It is ideal for online shopping because it offers 10x reward points at some of the most well-known online shopping and travel websites, such as Cleartrip, Apollo24x7, Netmeds, BookMyShow, Dominos, Yatra, and Lenskart. Previously, Amazon was also included in the list of sites that offered 10x Rewards; however, this offer no longer applies to Amazon, and the card now only offers 5x Rewards on Amazon. As for other online and offline spending, you earn 5x rewards on online purchases and one reward point for every Rs. 100 spent on all offline purchases.

Fees and Charges

- Fees: - Joining/Annual 499+GST

- Best Suited For: - Shopping

- Reward Type: - Reward Points

- Welcome Benefits: - 500 rupees worth of Amazon gift cards.

- Fee on Reward Redemption: - Rs. 99 par redemption request

- Interest Rates: - 3.5% per month (42% annually)

- Spend Based Waiver: - If you spent at least Rs. 1 Lakh or more in the past year, the renewal fee 499 +GST is waived.

- Fuel Surcharge: - Waiver of 1% fuel surcharge for fuel transactions in India between ₹500 to ₹3000. (Max 100 per month)

- Foreign Currency Markup: - 3.5% of the total transaction amount (plus applicable taxes)

- Cash Advance Charges: - 2.5% (Min. Rs. 500) of the withdrawn amount.

- Add-on Card Fee: - Nil

Reward and Benefits

- Movie & Dining: - NA

- Rewards Rate: - Get 5X Reward Points on online purchases, 10X Reward Points on partner brands (like BookMyShow and Apollo 24/7), and 1 Reward Point for every Rs. 100 spent on other purchases.

- Rewards Redemption: - Reward Points can be used to settle the outstanding balance on the card and to purchase gift cards on sbicard.com or through the SBI mobile app; 1 RP is equal to Rs. 0.25.

- Travel: - N/A

- Domestic Lounge Access: - N/A

- International Lounge Access: - N/A

- Insurance Benefits: - N/A

- Golf: - N/A

- Zero Liability Protection: - If a card is lost or stolen and reported to the bank in a timely manner, the cardholders are protected against all liability.

Product Details

- Amazon gift cards valued at Rs. 500 are a welcome benefit.

- 2,000-rupee e-vouchers from ClearTrip on net yearly expenditures of Rs. 1,00,000 and Rs. 2,00,000, respectively.

- 10X Reward Points can be earned for online purchases made at partner merchants, which include well-known websites like Amazon, BookMyShow, Apollo24x7, etc.

- 5X Reward Points when using your SBI SimplyClick Credit Card for any additional online purchases.

- 1 reward point for every 100 rupees spent offline, except fuel.

- 499 rupees in annual fees waived on spending Rs. 1,000,000 annually.

- For all fuel purchases of Rs. 500 to Rs. 3,000, the 1% fuel surcharge is waived.

Pros/Cons

Pros

- The welcome reward of an Amazon voucher worth Rs. 500 is one of the best features of the SBI SimplyClick Credit Card.

- When you reach milestone spends, you can also receive vouchers worth Rs. 4,000.

Cons

- For regular travelers, this card's lack of domestic or foreign lounge access is a major disadvantage.

- The SBI SimplyClick Credit Card does not offer any insurance advantages in addition to no travel perks.

SBI SimplyCLICK Credit Card Features and Benefits

Welcome Benefits:

- As a welcome gift, you receive an Amazon gift card worth Rs. 500 on payment of the card joining fee.

- After the joining fee is paid, you will receive a voucher code on the registered mobile number within 30 days.

- Within a year of the accrual date, the gift voucher will be valid.

Milestone Benefits:

- After spending Rs. 1 lakh with the card annually, you will receive an e-voucher worth Rs. 2,000 from ClearTrip.

- After spending Rs. 2 lakh with the card annually, you can receive an additional e-voucher worth Rs. 2,000 from ClearTrip.

- If the cardholder spent Rs. 1 lakh in a single year before renewal, there is no renewal membership fee.

Fuel surcharge waiver:

Zero Liability Protection:

SBI SimplyCLICK Credit Card Fees/Charges

- The Simply Click Credit Card has a yearly fees of Rs. 499 plus applicable taxes; however, if you spend Rs. 1 lakh or more in the preceding anniversary year, the annual fee is waived starting in the second year.

- This credit card has an interest rate of 3.5% per month, or 42% annually.

- When you use your SimplyCLICK SBI Credit Card to conduct a transaction in a foreign currency, you will be charged a foreign currency markup fee, which is 3.5% of the entire transaction value.

- When you use your SBI Simply Click Credit Card to withdraw cash, you will be charged a cash advance fee of 2.5% of the transaction amount, with a minimum of Rs. 500.

SBI SimplyCLICK Credit Card Rewards

- 1 reward point for every Rs. 100 spent offline using the card (reward rate of 0.25%).

- 10X Reward Points (10 Points per Rs. 100) on online purchases at partner merchants (reward rate of 2.5%), except on gift cards, utility bill payments, and recharges on Amazon, and on Cleartrip, BookMyShow, Dominos, Lenskart, Yatra, Apollo24x7, Myntra, and Netmeds.

- 5X Reward Points (reward rate of 1.25%) on all further online purchases made using the card.

- The Bonus has a maximum cap of 10,000 Reward Points per month (at a 5X or 10X rate). Documentation is required.

Reward Redemption:

- Go to SBI Card's official website.

- Click the "Rewards" option.

- A lot of products will be displayed on your screen.

- To redeem your points against a product, click on it.

- Select "Points Only" if you are paying with just points and select "Points + Pay" if you are using partial points and must pay the remaining balance.

- To redeem your points, log in with your card details or registered mobile number.

- Log in to sbicard.com.

- Choose Mailbox from the main menu.

- Choose the option "Reward Points Redemption" under the category.

- Choose "Request for redemption" from the choice subcategory, then send the email as usual.

SBI SimplyCLICK Credit Card Eligibility Criteria

- For self-employed and salaried applicants, the age range should be 18 to 65 years old.

- The monthly minimum eligible income for salaried employees is Rs. 20,000.

- The minimum monthly income requirement for people who are self-employed is Rs. 20,000 (as per ITR).

Required Documents:

- Pan Card

- Address Proof, such as recent utility bills, a rental agreement, an Aadhar card, a passport, etc.

- Income Proof, you can provide the most recent salary slips and bank statements, or in the case of self-employed individuals, the most recent audited ITR.

Apply for the SBI SimplyCLICK Credit Card

- On this page, click the "Apply Now" button.

- Add your information,

- Your application will be submitted.

Check SBI SimplyCLICK Credit Card Application Status:

- Go to the official SBI Card website.

- Select the "Credit Cards" option.

- Scroll down until you see the option 'Track Application.' Click on it.

- Enter the application number that was given to your registered phone number, then click 'Track.'

- In a few of seconds, your screen will display the status of your card application.

SBI SimplyCLICK Credit Card Customer Care

- You can submit queries or complaints about your credit card to customercare@sbicard.com and send them over the Email.

- You may call any of the following helplines to get in touch with the customer: 1800 180 1290 (toll-free), 1860 500 1290, 1860 180 1290, or 39 02 02 02.

Review of the SBI SimplyCLICK Credit Card

FAQs:

What is the SBI SimplyClick Credit Card annual fee?

The SBI SimplyCLICK Credit Card has an annual membership fee of Rs. 499 (plus applicable taxes).

What is the SBI SimplyClick Credit Card interest rate?

3.50% p.m. (42% annually)

What is the SBI SimplyClick Credit Card reward point validity?

The Reward Points that can be earned on the SBI SimplyCLICK Credit Card, or any other SBI Card credit card, are valid for a period of 2 years or 24 months.

Does the SBI SimplyClick Credit Card come with complimentary access to airport lounges?

- No, there is no complimentary airport lounge access offered with the SBI Simply Click Card

SBI SimplyCLICK Credit Card

SBI SimplyCLICK Credit Card

Rating: 5/5